- +91 9828164143

- maroocapital1@gmail.com

- Udaipur, Rajasthan

For the past few days, investors in the Indian stock market have been very busy. The market has seen a plethora of Initial Public Offerings (IPOs), but Nifty and Sensex are rising to all-time highs. In the midst of all of this, the first Tata Group IPO in nearly 20 years, the Tata Technologies IPO, has received approval from the Securities and Exchange Board of India (SEBI).

Several Tata Group shares have gained momentum as you eagerly await the opening of this IPO to the public. However, there are a few things you should be aware of before investing your hard-earned money in this IPO.

Start Investing with Free Expert Advice

Tata Technologies provides information technology (IT) solutions and engineering services to customers worldwide. The business has extensive experience and domain knowledge in the automotive sector as well as related fields like heavy machinery construction, transportation, and aviation. The business is a part of the esteemed Tata Group and is a subsidiary of Tata Motors.

After the 2004 IPO of Tata Consultancy Services, this would be the first Tata Group IPO in 19 years with the debut of Tata Technologies. The business was first incorporated in 1994 under the name “Core Software Systems.” In 2001, the Tata Group purchased the company, and it changed its name to “Tata Technologies.”

The company’s advantages include:

Among the risk factors or shortcomings connected to Tata Technologies are:

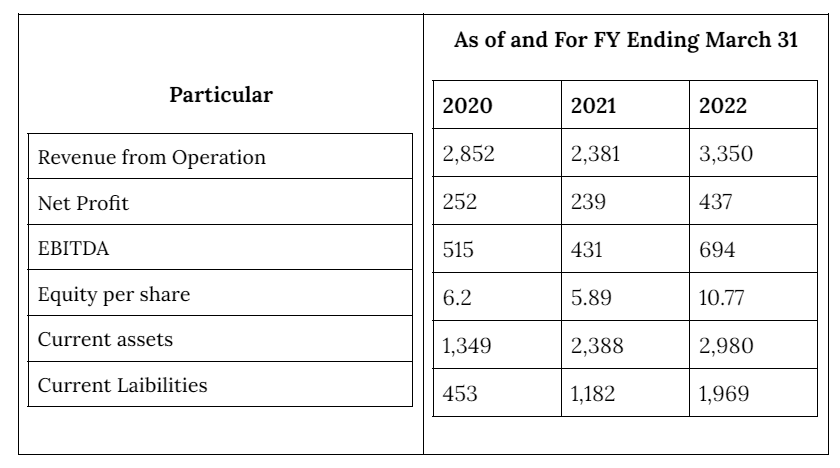

The business has benefited from its ability to enter the growing EV market. Between FY 2021 and FY 2022, revenues increased significantly from Rs. 2,381 crores to Rs. 3,530 crores in a single year. During the same time period, the company’s net profit climbed significantly as well, rising from Rs. 239 crores to Rs. 437 crores.

The company’s liabilities increased from 453 crores in FY 2020 to 1,696 crores in FY 2022, but the value of its total assets also skyrocketed. Examine the following table to gain insight into Tata Technologies’ financial position:

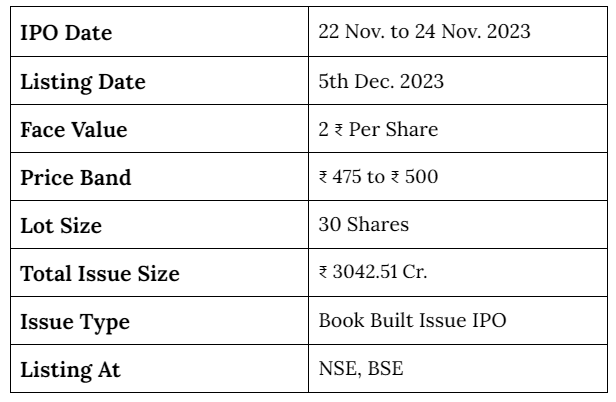

The Tata Group received approval in July 2023 after submitting the initial paperwork for the Tata Technologies IPO in March 2023. With shareholdings offloading up to 9.57 crore units or 23.60% of the company’s paid-up share capital, the issue will be a complete offer for sale (OFS). It is estimated that the IPO will be valued at least Rs. 4,000 crores, even though the issue size has not yet been revealed.

Qualified Institutional Buyers (QIBs) will be allocated roughly 50% of the offer, retail investors will receive 35%, and non-institutional investors will receive the remaining 15%. The company has not yet disclosed other information, such as the IPO opening and closing dates, lot size, allotment finalization, and listing date. But the mid-July 2023 IPO is anticipated to hit the stock markets.

How should I prepare for the Tata Technologies IPO before investing?

The rich history of the Tata Group and the present market conditions are major factors supporting the subscription of Tata Technologies’ initial public offering. The company is well-positioned for future growth due to its capacity to serve its global clientele and capitalize on the burgeoning electric vehicle market. Naturally, one of the most anticipated IPOs of 2023 is this one.

However, you must consider the company’s business verticals, financials, promoters, and other details before investing your hard-earned money in an IPO. To invest in initial public offerings (IPOs), you can open a Demat account with Motilal Oswal at no cost.

Maroo Capital Associated with Motilal Oswal Financial Services Ltd.